Managing finances as a student is no walk through the park given the fact that most teenagers jumping headfirst into adulthood knowing nada about budgeting or saving up. So, in most cases, when college students step into adulthood, they are total strangers to the whole financial independence scenario – an issue that eventually costs them a lot.

Pexels | Save the Student is a UK organization looking to help out university students

Lack of Proper Financial Education

While schools efficiently teach them about the sciences, humanities, and mathematics, students are rarely ever provided with essential life skills like budgeting, finances, and taxes. This results in university students struggling with their money and living paycheck to paycheck. Matters only get worse if the student has taken student loans as well. A survey conducted by ‘Save the Student’ in 2020 showed that approximately 71% of participants said they wished to understand finances better. One in four students was completely oblivious about the scholarships or grants – meaning that one in four students missed out on the opportunity for affordable education.

These figures show the grim reality of our society. Tom Allingham from ‘Save the Student’ talks about the fact that university students who do not have a working understanding of finances have to deal with additional issues throughout their school life. No one wants that so, we’re here to outline some tips to help you take control of your finances.

1. Start Budgeting

Once you start budgeting, you'll never go off-track since everything you need will already be present in your list. Budgeting can also help in saving money and keep a record of your finances. You can make yourself a grocery list every month while leaving room for takeaways and dine-in occasionally. There are numerous guides on the internet on how to budget. You can even start by heading to Save the Student website.

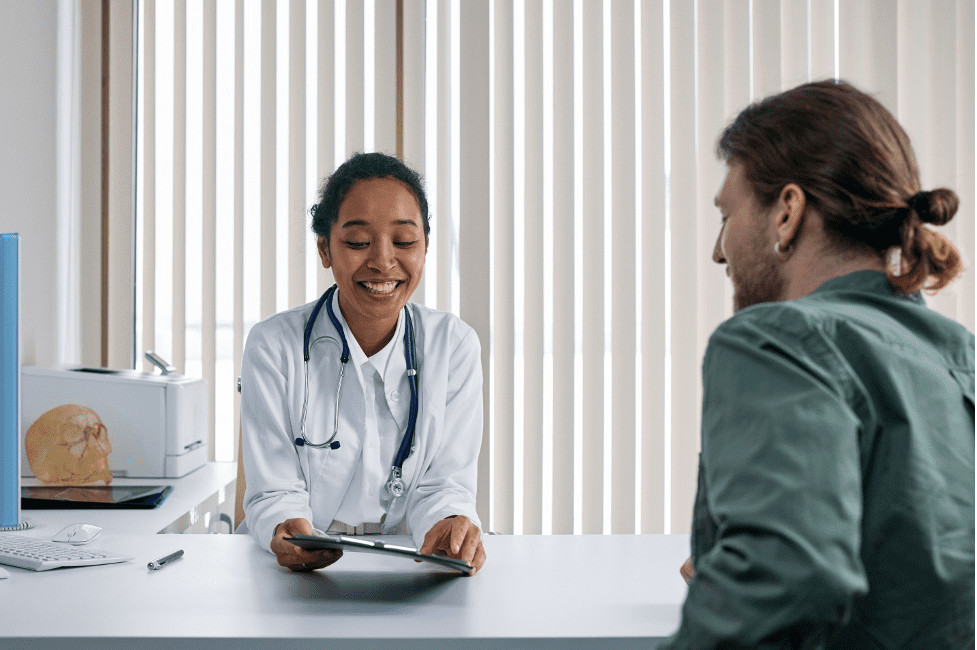

Pexels | Make a budget and stick to it

2. Get A Saving Account

If you keep your money in your wallet or anywhere in your dorm room, then you need to get yourself a saving account. When you don't have extra money on hand all the time, you’ll easily be able to fight the temptation to spend money. This can also be beneficial for people who tend to overspend.

3. Student Discounts

You may not know it, but many restaurants and stores provide student discounts. Similarly, there are websites like Studentbeans and UniDAYS that provide university students with various discounts on all sorts of brands, including Apple and Asos - all you need to do is hop on your laptop and register.

Pexels | Don’t forget to introduce your friends to your cool new finds

Financial management is a proper skill, and you can't learn it overnight, but these tips can help you get started.